Deposits, also known as down payments, can be a touchy subject in any industry. And construction is no exception.

Even seasoned business leaders struggle with how to steer a conversation toward fees. So, if you find the whole process of securing a contractor deposit a bit awkward, know you’re not alone.

Many contractors fear that asking for a deposit in their contract will cause customers to run. In fact, most don’t ask for one. But considering that only half of contractors get paid on time, requiring a deposit is a smart business move.

Asking for a contractor deposit is a good way to guard against the cash flow issues many contractors face. Plus, it ensures your customer is serious and reliable. That said, a bit of finesse is required to ensure you don’t offend or scare off a legitimate potential customer.

In this article, we’ll go over how to ask for a deposit, how to address common objections, and other best practices for getting a contractor deposit.

A big consideration when deciding how to ask for a deposit is local law.

In New York, for example, contractors must put down payments into an escrow account. Then, they can only use that cash for that customer’s job until the job is substantially complete—or else prove they have bond insurance to protect the customer’s money.

In California, contractors cannot ask for a deposit of more than 10% of the total cost of the job or $10,000, whichever is less.

To avoid fines or other penalties, it’s vital that you understand local laws governing contractor deposits before requesting one from a customer. Consulting a legal professional in your area may be helpful to stay in compliance.

Most fears your customers will have about contractor deposits will fall into just a few buckets. Here are the most common concerns customers raise and some suggestions for how to prepare an effective response.

Customers new to working with a contractor often fail to grasp why contractors need a deposit to begin work. If a customer asks you this, explain that a contractor deposit is required to assemble the crew, rent the equipment, and order the materials you need to begin work on the project.

You may also wish to add that a deposit secures them space on your schedule, which is required before you can begin work.

Entering into business with a new party always requires a leap of faith to one degree or another.

If a customer is worried that you’ll take their money and run, point them to third-party sources that can verify your track record of honest business dealings, such as:

If a customer still lacks trust even after all that, it may be helpful to explain that beginning work requires a degree of trust on your end as well. An upfront payment helps establish good faith on both sides.

This question stems from a fundamental misunderstanding of what a contractor deposit is.

To head off this confusion, make sure the customer understands from the jump that the deposit is a down payment on work that will be applied against the total cost of the job.

To reassure customers who are on the fence, you may wish to include a clause in your contract that provides a time period during which a customer may cancel the job and receive their deposit back. This period should close before you invest in any materials, labor, or equipment for the job.

Need an easier way to collect deposits? Joist can help.

To avoid any surprises or the perception that a deposit is being “sprung” on a customer, you should always discuss the contractor deposit amount when you negotiate the overall project payment plan.

For complete transparency, include any contractor deposits as line items in your quote. No matter what, the contractor deposit amount should be set before you even consider adding a customer to your schedule.

To ensure customers don’t feel singled out, frame contractor deposits as a general policy. In other words, it’s not about them—it’s just your way of doing business.

The upside of operating in a jurisdiction that limits contractor deposit amounts is that determining how much to ask for a deposit is relatively straightforward.

If state law says you can’t ask for more than 10%, then that’s a pretty good starting point. Otherwise, contractors generally ask for between 10–25% as an initial deposit to add a customer to their schedule.

Another common payment plan you’ll encounter is 33% paid upfront, 33% due at some pre-specified degree of progress, and 33% as a final payment.

Ultimately, anything over 50% would be nonstandard, so try not to go above that amount. Although, particularly complex jobs may require something in that ballpark to be feasible.

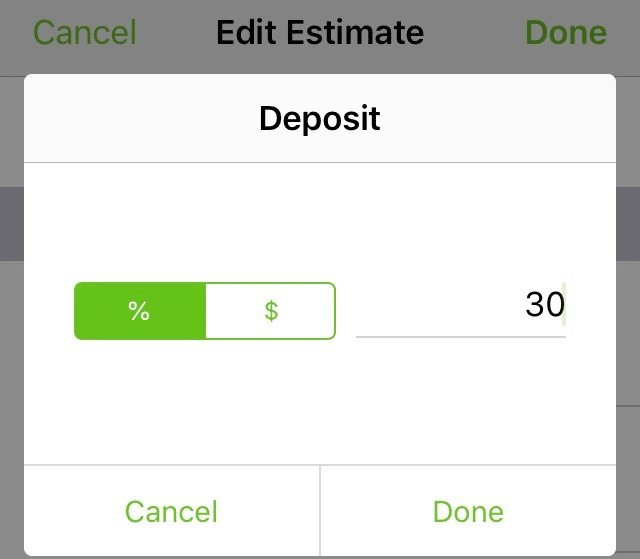

Another consideration beyond determining the contractor deposit amount is deciding how you’re going to bill for the deposit.

As with billing in general, a range of options exists. The right choice for you will depend on your business’s needs.

The best practice here is to keep it simple—simple for you to create and simple for the customer to understand.

In 2023, that means digital invoicing, whether it’s sent to the customer’s email or they pay you in person. Your deposit invoice should display all critical information in a neat and simple layout.

Modern contractor invoicing software makes the process of drafting and sending an attractive, professional digital invoice easier than ever. But regardless of how it’s delivered, your deposit invoice must include:

The deposit terms (or payment terms) should, in plain language, lay out both parties’ rights and responsibilities upon payment of the deposit.

State up front if payment is required before work can start, and specify the payment deadline 30 days from the invoice date is the standard practice in most industries, construction included.

This is also where you can include incentives to pay early, such as a discount if the customer pays within 10 days instead of the full 30. Any credit card processing fees or cash discounts should be detailed in the payment terms as well.

Finally, the deposit terms section is where you’ll include any penalties for late payment. A 1% late penalty for each month the invoice goes unpaid is standard. This helps counter inflation and incentivizes customers to pay on time.

In all but the most complex cases, you should be able to state these terms in just a few sentences. Example deposit terms might look like the following:

Terms: Full payment of this deposit is required before work can begin. Payments are due 30 days from the invoice date. A 2% processing fee will be charged for all credit card transactions. Overdue payments are subject to a late fee of 1% for each month they go unpaid.

A cordial “thank you for your business” or similar reminder that you value the customer can serve as a nice footer for the invoice.

All payments should be associated with an invoice, contractor deposits included. Staying organized in this way is critical for recordkeeping, especially income taxes and other accounting purposes.

Considering the potential discomfort about how to ask for a deposit politely, you may be tempted to ask for the deposit in writing. However, asking in person can often be more persuasive, if done right.

With that in mind, here are a few tips to keep in mind to help you ask for a deposit politely in person.

With money matters, checking in on a personal level before jumping straight to business can make the relationship feel less transactional.

We’ve listed possible responses to some of the most common questions above. Feel free to use these responses as a jumping-off point to prepare your own responses to potential customer concerns.

Frame the request in terms of the benefits for the customer and explain that you’re asking because it’s standard procedure, not because of anything the customer did.

Mention that committing now with a contractor deposit will allow you to add them to your schedule and begin the job as soon as possible.

As a business owner, you always want to receive payments sooner. The biggest benefit of asking for a deposit in person is that the customer can sign and pay on the spot if they agree to the terms.

For a streamlined process, have your deposit and invoice system ready before going into the meeting with the customer. With a mobile deposit and invoicing solution, you can draft the invoice, present it to the customer in a professional manner, and securely receive your payment in minutes.

A quick and easy collection process can reduce any friction associated with requesting deposits in person.

There will be numerous situations where you’ll need to ask for a deposit in writing. Writing isn’t everyone’s strong suit, but if you follow just a few principles, you can craft an effective message asking for a contractor deposit.

Email is a convenient way for both you and your customers to complete the deposit process. Here are some tips for writing a contractor deposit email:

Here’s an example of an email requesting a deposit. Feel free to use it as inspiration or copy and paste it and input your own details.

I hope you’re doing well! I wanted to discuss an important step to ensure a smooth start to our collaboration. Before we begin providing our services, I kindly request a deposit to be paid.

To facilitate a seamless workflow and allocate necessary resources, we require a deposit of [amount or percentage] by [due date]. This enables us to initiate the project promptly and deliver exceptional results.

Deposit payments can be made by [payment method and instructions].

Upon receiving your deposit, we’ll promptly confirm and acknowledge its receipt. Your trust in our services is valued, and I’m available to address any questions or concerns you may have.

Thank you for your cooperation. We look forward to a successful collaboration.

If you’re asking for a contractor deposit, that needs to go in your contract. Here are a few tips for including the deposit in your contract:

Here’s an example of how to include a deposit requirement clause in your client contract. Again, feel free to use this example directly or as a basis to modify for your business.

The Client agrees to pay a non-refundable deposit of [amount or percentage] of the total project cost to initiate the work. The deposit can be made via [payment method and instructions]. The Client is required to submit the deposit within [number of days] days from contract signing. Electronic signatures are accepted as legally binding. The deposit is non-refundable, and in case of cancellation, it serves as compensation for the Contractor’s reserved time and resources.

Having a streamlined, frictionless contractor deposit invoice process eliminates common hiccups for customers who are ready and willing to make a down payment on a project.

Here are a few ways to make this process easier:

The benefits of consolidating your tech stack are numerous, including simplifying the process of collecting contractor deposits.

An all-in-one solution tailored to the needs of contractors not only helps with accepting invoices, but also with estimating and creating invoices. It’s an essential component of making this process painless.

Setting expectations from the beginning is critical to securing your contractor deposit. Reiterating the same information at each stage ensures that requests for a deposit don’t come as a surprise.

Laying out the payment schedule in your project plans also helps customers see the payments in a bigger context and sets proper expectations for the duration of the project.

A key benefit of contractor deposits is evening out your cash flow. Accepting progress payments allows you to hold onto many of those same benefits.

Progress payments can be made as work milestones are completed or on a monthly basis.

This type of payment method can help customers budget for major work projects without having to cough up a major payment upfront. It also ensures that contractors receive regular payments along the way, with the penalty of a total work stoppage if the customer fails to make a payment.

The decision of whether to accept progress payments requires some thought, to be sure, but is worth consideration.

Like asking for a contractor deposit in general, following up on a deposit request can be a delicate matter. The key is to not make a customer feel singled out or pressured, while ensuring they understand work cannot begin until a payment is made.

Here again the same principles—clear, consistent communication and focusing on benefits to the customer—will ensure you don’t scare off any legitimate clients as you hold your ground.

Need an easier way to collect deposits? Joist can help.